USDA

(Source: OTEXA)

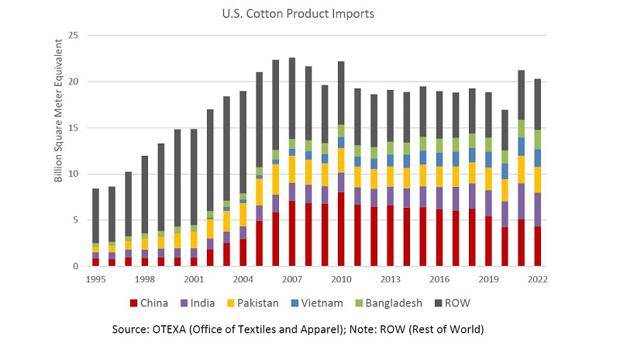

The USA is the largest importer of cotton products and nearly all US consumer retail purchases of these goods are imported. Cotton product imports in 2022 were down after reaching the highest level in a decade (measured in m² equivalent).

According to data from the International Trade Administration’s Office of Textile and Apparels (OTEXA), Washington, DC/USA, 2022 cotton products were, however, a record $57.0 billion, nearly $8.0 billion higher than the previous year. Despite lower import volumes, higher value was attributed to greater unit values and U.S. consumers’ sustained demand for goods. Robust levels of consumer discretionary income, low unemployment, and higher wage growth have all supported strong purchases despite consumer inflation.

China remained the largest cotton product supplier for the 20th consecutive year. This was despite Section 301 tariffs implemented in 2019 amid the US-China trade dispute and the Uyghur Forced Labor Prevention Act (UFLPA) that went into effect on June 21, 2022. The UFLPA establishes that the importation of any goods, etc., wholly or in part in the Xinjiang Uyghur Autonomous Region of PR China are barred from entry into the USA. The Xinjiang autonomous region produces roughly 90% of China’s cotton, making much of Chinese cotton product exports potentially susceptible to the law.

Cotton’s market share of total apparel imports (including all fibers) fell from the previous year to roughly 40%. Man-made fibers (MMF) including polyester (PET), polyamide (PA), spandex (elastane), and acrylic tied its record for market share among all US apparel imports at nearly 60%.

China is the largest manufacturer of man-made synthetic yarns (which are ultimately used to manufacture MMF apparel), accounting for roughly 60% of world production. For the past decade, competitively priced MMF products have been a major factor slowing global growth in cotton consumption.

According to data from the International Trade Administration’s Office of Textile and Apparels (OTEXA), Washington, DC/USA, 2022 cotton products were, however, a record $57.0 billion, nearly $8.0 billion higher than the previous year. Despite lower import volumes, higher value was attributed to greater unit values and U.S. consumers’ sustained demand for goods. Robust levels of consumer discretionary income, low unemployment, and higher wage growth have all supported strong purchases despite consumer inflation.

China remained the largest cotton product supplier for the 20th consecutive year. This was despite Section 301 tariffs implemented in 2019 amid the US-China trade dispute and the Uyghur Forced Labor Prevention Act (UFLPA) that went into effect on June 21, 2022. The UFLPA establishes that the importation of any goods, etc., wholly or in part in the Xinjiang Uyghur Autonomous Region of PR China are barred from entry into the USA. The Xinjiang autonomous region produces roughly 90% of China’s cotton, making much of Chinese cotton product exports potentially susceptible to the law.

Cotton’s market share of total apparel imports (including all fibers) fell from the previous year to roughly 40%. Man-made fibers (MMF) including polyester (PET), polyamide (PA), spandex (elastane), and acrylic tied its record for market share among all US apparel imports at nearly 60%.

China is the largest manufacturer of man-made synthetic yarns (which are ultimately used to manufacture MMF apparel), accounting for roughly 60% of world production. For the past decade, competitively priced MMF products have been a major factor slowing global growth in cotton consumption.

2022/23 Outlook

Global production is up from the previous month to 115.1 million bales and attributed to higher production in China, Australia, and Uzbekistan more than offsetting India’s lower crop.

Consumption is forecast down more than 500,000 bales from the previous month due to lower consumption in Pakistan, Turkey, Bangladesh, and Indonesia due to an array of country-specific factors. Both Pakistan and Bangladesh are experiencing issues opening and executing letters of credit along with declining profit margins amidst higher electricity costs. Turkey’s earthquake adversely affected mills in the area and Indonesia imports are forecast at the lowest level since 1990.

The full report is available from the United States Department of Agriculture (USDA), Washington, DC/USA.