USDA

(Source: USDA)

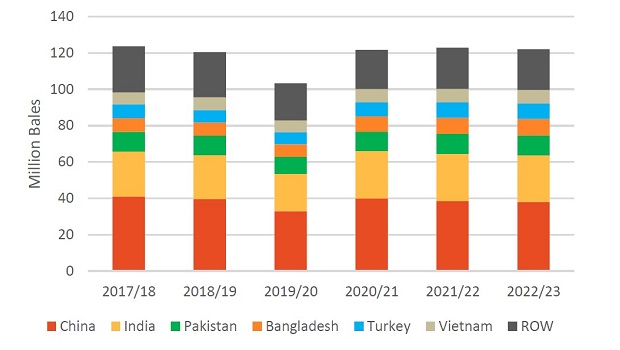

Global cotton consumption is forecast at 122.0 million bales, down 1.0 million bales from the previous year. The highest cotton prices in 11 years and concerns regarding the global macro-economic environment are expected to cap consumption growth. Although consumption is projected to decline, this would still be the second highest level within the last 5 years.

Higher costs of food, transportation, and housing will limit spending on cotton products (e.g., apparel, home textiles such as bed sheets and towels, etc.). Spending on home textiles and improvements witnessed significant gains following the implementation of widespread Covid-19 lockdowns, and these expenditures are expected too now slow. Consumers are expected to devote a greater share of disposable income to services relative to non-durable goods such as apparel this year and next year.

Of the top 10 consuming countries, 4 (India, China, the USA, and Uzbekistan) are expected to decline; Turkey and Brazil are forecast unchanged from the previous year. Pakistan, Bangladesh, and Vietnam are expected to witness consumption growth. Greater spinning capacity in South and Southeast Asia is expected to drive greater cotton lint demand in these regions. However, despite greater spinning capacity relative to pre-Covid levels, India consumption is expected down and partly due to the lowest projected domestic supplies in 4 years.

Global trade is forecast up from the previous year to its second-highest level ever. China is projected to be the largest importer for the third consecutive year at 10.5 million bales due to strong demand to replenish state reserves and commercial stocks of foreign cotton in consignment.

The outlook for 2021/22 shows global production is lowered 1.8 million bales from last month, largely due to a drop of 1.0 million bales from India. Global use is down 1.1 million bales, and ending stocks are up 271,000 bales. Global trade is down slightly with a drop of 500,000 bales in India exports. Additionally, imports are lower for China, Pakistan, and Vietnam.

Higher costs of food, transportation, and housing will limit spending on cotton products (e.g., apparel, home textiles such as bed sheets and towels, etc.). Spending on home textiles and improvements witnessed significant gains following the implementation of widespread Covid-19 lockdowns, and these expenditures are expected too now slow. Consumers are expected to devote a greater share of disposable income to services relative to non-durable goods such as apparel this year and next year.

Of the top 10 consuming countries, 4 (India, China, the USA, and Uzbekistan) are expected to decline; Turkey and Brazil are forecast unchanged from the previous year. Pakistan, Bangladesh, and Vietnam are expected to witness consumption growth. Greater spinning capacity in South and Southeast Asia is expected to drive greater cotton lint demand in these regions. However, despite greater spinning capacity relative to pre-Covid levels, India consumption is expected down and partly due to the lowest projected domestic supplies in 4 years.

Global trade is forecast up from the previous year to its second-highest level ever. China is projected to be the largest importer for the third consecutive year at 10.5 million bales due to strong demand to replenish state reserves and commercial stocks of foreign cotton in consignment.

The outlook for 2021/22 shows global production is lowered 1.8 million bales from last month, largely due to a drop of 1.0 million bales from India. Global use is down 1.1 million bales, and ending stocks are up 271,000 bales. Global trade is down slightly with a drop of 500,000 bales in India exports. Additionally, imports are lower for China, Pakistan, and Vietnam.