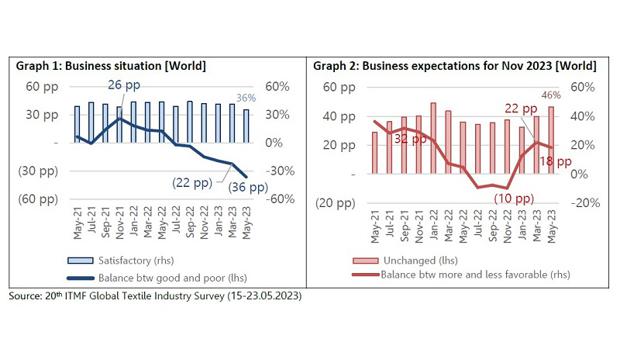

The global business situation in the textile value chain deteriorated further in May 2023 (Graph 1) and hit a new low at -36 percentage points (pp). Across the board companies are currently struggling with a poor order intake on one hand and rising production costs on the other. The industry is faced with the ingredients of a “perfect storm”. The majority of global textile value chain is expecting this current scenario to last until the end of 2023 (Graph 2). Since the beginning of the year business expectations have been back to positive territory. While in November 2022 they were still at -10 pp, they reached +22 pp in March 2023. In May 2023 they fell slightly back to +18 pp. At the same time, companies’ expectation for the business climate in 6 months-time have been improving since November 2022. It is unclear if this growing optimism about the mid-term future is due to a belief that the situation cannot get much worse or anticipation for a well-founded economic normalization.

These are the results of the 20th ITMF Global Textile Industry Survey (GTIS) conducted by the International Textile Machinery Federation (ITMF), Zurich/Switzerland.

Order intake dropped further in May 2023 to a new low. Most regions and segments saw a fall in order intake, especially North and Central America and in the segment of fibers. “Weakening demand” remained the major concern for the global textile industry since July 2022. “Inflation” remains the second major concern worldwide and gained importance. Worries about “Geopolitics” have increased and now feature among the main concerns.

The survey also shows that the level of order cancellations remains low, albeit slightly higher than 4 months ago. 51% of respondents to the 20th GTIS recorded no order cancelations during the last 4 months (down from 53% in March and 58% in January). South America is the region with the highest level of order cancelations, segment-wise fiber producers were impacted the most. Inventory levels fell slightly in May compared to March. South America recorded the highest inventory level. As segments, home textile producers as well as dyers/finishers/printers reported the highest inventory levels.