Composites Germany

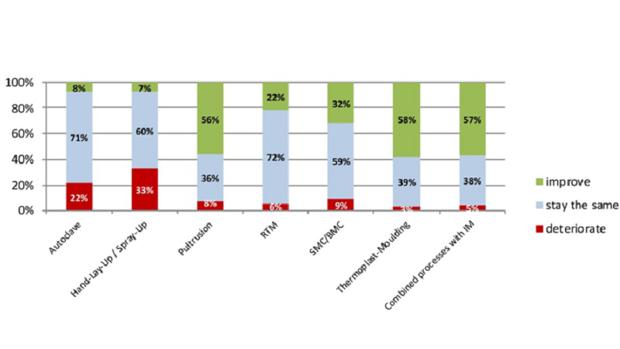

Assessment of the development of selected areas of application (Source: Composites Germany)

The composites industry has also been affected by challenges such as the consequences of the corona pandemic, the shortage of semiconductors, problems in the logistics chains and a sharp rise in raw material prices. In addition, there have been other individual effects that have further increased the pressure on the industry.

The main challenges during 2022 were primarily a steep increase in energy and fuel prices and the cost of logistics. In addition, the war in Ukraine put a further strain on supply chains that had already been weakened.

These effects have further dampened the mood in the composites industry. The index assessing the current general business situation in Germany and Europe has dropped even lower than before. However, the assessment of the global situation is somewhat more positive. Despite this generally negative assessment of the current situation, companies are moving in a somewhat more positive direction in the assessment of their own business situations. The companies that were surveyed rated their own positions more positively than in the last survey.

The expectations on future market developments are showing a very positive picture. After a significant drop in the last survey, the indicators for the general business situation are now displaying a clear upward trend again.

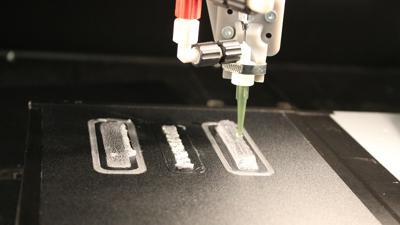

The investment climate has remained at a stable level. Nearly half of the companies surveyed are planning to employ new staff over the next six months. As before, about 70% of respondents are either considering or planning machine investments.

The composites market is highly heterogeneous in terms of both materials and applications. In the survey, respondents were asked to assess the market developments of different core areas.

Expectations turned out to be extremely diverse (see Fig.).

The most important application segment for composites is the transport sector. The number of new registrations of passenger cars has been declining in recent years. This is where we can see OEMs moving away from volume models and opting for more profitable mid-range and premium segments. In this year’s survey, this shows itself in relatively cautious expectations for this segment.

The currently rather pessimistic outlook for the construction industry is leading companies to expect major slumps in this sector. The building sector, in particular, often reacts rather slowly to short-term economic fluctuations and has long been relatively robust towards the aforementioned crises. Now, however, it seems that this area, too, is being affected by negative influences.

The pessimistic outlook on the sports and leisure sector can be explained by a rather pessimistic view of consumer behavior.

Expectations about future market developments, on the other hand, are significantly more positive than the figures presented here might suggest.

Outlook

Despite the many negative influences that have occurred recently, composites appear to be in good shape for the future. Thanks to excellent market developments in 2021, they have almost reached their pre-pandemic level. The outlook for market developments in 2022 have not been finalized but are showing a less positive trend for last year.

Nevertheless, there are many indications to suggest that the generally positive development of the composite industry over the last few years is set to continue. In the medium term, structural changes in the transport sector will open up opportunities for composites to gain a new foothold in new applications. Major opportunities can be seen in areas of construction and infrastructure. Despite the rather weak market situation, these areas offer enormous opportunities for composites, due to their unique properties which predestine them for long-term use. The main assets of these materials are their durability, their almost maintenance-free use, their potential for use in lightweight construction and their positive impact on sustainability. Furthermore, one major growth driver is likely to be the wind industry, provided that it meets the politically self-imposed targets for the share of renewable energies in power consumption.

For the 20th time, the trade association Composites Germany e.V., Berlin/Germany, has identified the latest performance indicators for the fiber-reinforced plastics market. The survey covered all the member companies of the 3 major umbrella organizations of Composites Germany: Industrievereinigung Verstärkte Kunststoffe e.V. (AVK), Frankfurt/Germany, Leichtbau Baden-Württemberg GmbH, Stuttgart/Germany, and the VDMA Working Group on Hybrid Lightweight Construction Technologies, Frankfurt.

The main challenges during 2022 were primarily a steep increase in energy and fuel prices and the cost of logistics. In addition, the war in Ukraine put a further strain on supply chains that had already been weakened.

These effects have further dampened the mood in the composites industry. The index assessing the current general business situation in Germany and Europe has dropped even lower than before. However, the assessment of the global situation is somewhat more positive. Despite this generally negative assessment of the current situation, companies are moving in a somewhat more positive direction in the assessment of their own business situations. The companies that were surveyed rated their own positions more positively than in the last survey.

The expectations on future market developments are showing a very positive picture. After a significant drop in the last survey, the indicators for the general business situation are now displaying a clear upward trend again.

The investment climate has remained at a stable level. Nearly half of the companies surveyed are planning to employ new staff over the next six months. As before, about 70% of respondents are either considering or planning machine investments.

The composites market is highly heterogeneous in terms of both materials and applications. In the survey, respondents were asked to assess the market developments of different core areas.

Expectations turned out to be extremely diverse (see Fig.).

The most important application segment for composites is the transport sector. The number of new registrations of passenger cars has been declining in recent years. This is where we can see OEMs moving away from volume models and opting for more profitable mid-range and premium segments. In this year’s survey, this shows itself in relatively cautious expectations for this segment.

The currently rather pessimistic outlook for the construction industry is leading companies to expect major slumps in this sector. The building sector, in particular, often reacts rather slowly to short-term economic fluctuations and has long been relatively robust towards the aforementioned crises. Now, however, it seems that this area, too, is being affected by negative influences.

The pessimistic outlook on the sports and leisure sector can be explained by a rather pessimistic view of consumer behavior.

Expectations about future market developments, on the other hand, are significantly more positive than the figures presented here might suggest.

Outlook

Despite the many negative influences that have occurred recently, composites appear to be in good shape for the future. Thanks to excellent market developments in 2021, they have almost reached their pre-pandemic level. The outlook for market developments in 2022 have not been finalized but are showing a less positive trend for last year.

Nevertheless, there are many indications to suggest that the generally positive development of the composite industry over the last few years is set to continue. In the medium term, structural changes in the transport sector will open up opportunities for composites to gain a new foothold in new applications. Major opportunities can be seen in areas of construction and infrastructure. Despite the rather weak market situation, these areas offer enormous opportunities for composites, due to their unique properties which predestine them for long-term use. The main assets of these materials are their durability, their almost maintenance-free use, their potential for use in lightweight construction and their positive impact on sustainability. Furthermore, one major growth driver is likely to be the wind industry, provided that it meets the politically self-imposed targets for the share of renewable energies in power consumption.

For the 20th time, the trade association Composites Germany e.V., Berlin/Germany, has identified the latest performance indicators for the fiber-reinforced plastics market. The survey covered all the member companies of the 3 major umbrella organizations of Composites Germany: Industrievereinigung Verstärkte Kunststoffe e.V. (AVK), Frankfurt/Germany, Leichtbau Baden-Württemberg GmbH, Stuttgart/Germany, and the VDMA Working Group on Hybrid Lightweight Construction Technologies, Frankfurt.